Liu Jian, Ph.D, Chief Director CBPC

Liu Jian is an engineering graduate with biotechnology major from East China University of Science and Technology with more than 20 years of business management experience. Currently, he is the director of the CBPC, the Executive Director of Sichuan Microbiology Society, the Director of China Medium and trace elements and Fertilizer Industry, University and Research Innovation Alliance and the member of Chinese Microbiology Society, Shanghai Microbiology Society and Shanghai Bioengineering Society.

Since 1997, he has been engaged in the mechanism and application research of microbial fertilizer and microbial pesticide. He worked at the National Biochemical Engineering Technology Research Center of the Ministry of Science and Technology (Shanghai) for 15 years, specializing in the application research of online detection and computational analysis technology of metabolic flow in microbial cell culture, as well as the research and marketing of fermentation process optimization and amplification and related engineering application technology. He has many awards and achievements under his belt. He has 13 different patents and 9 published papers to his credit.

He is now fully responsible for JH UNION LABORATORIES Co., LTD., a leading company in technological innovation, focusing on the research, development, production and sales of microorganisms and their specific functional metabolites using the principles of synthetic biology.

What is CBPC’s vision? What does CBPC want to achieve for the Chinese agriculture and the biostimulants industry?

CHINA BIOSTIMULANTS PROFESSIONAL COMMITTEE (CBPC) is a professional organization for the research, development, and application of biostimulants. Its development purpose is “Joint innovation, Scientific experiment, Resource reassignment, Optimization cost, Sustainable development.” CBPC is a branch of the China Inorganic Salt Industry Association (CISIA). Its goal is to promote biostimulant companies, application users, scientific institutes, colleges, and universities to carry out industry-university-research cooperation to promote the technical progress of the industry. The main aim is to enhance China’s biostimulants company and products to reach the international level. It also carries out technical exchanges, development research, standard setting, qualification recognition, professional training, and other related activities to achieve the application and commercial implementation of new technologies and products.

The Chinese biostimulants market is showing similar growth as the global market. What are the major drivers behind the growth of biostimulants in China? How are biostimulants revolutionizing Chinese agriculture?

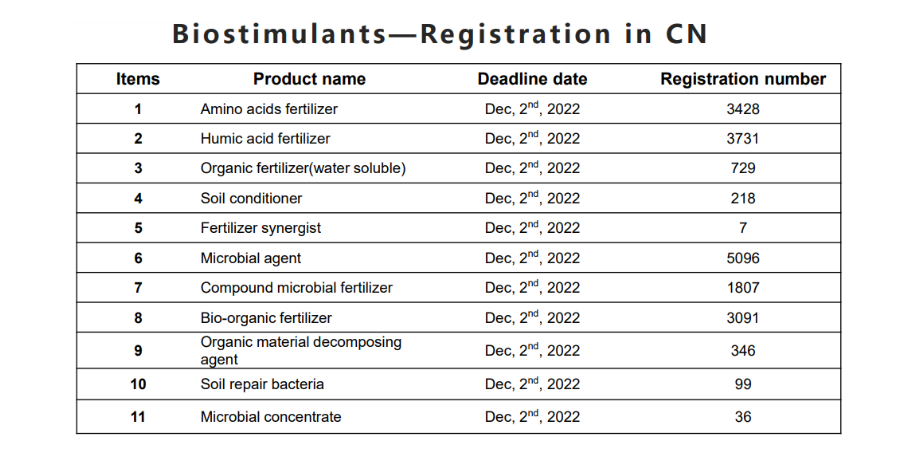

The global biostimulants market was valued at $3.4 billion in 2021 and is expected to reach approximately $8.71 billion by 2030, with a CAGR of 11.02%. The market size of China’s biostimulants was about 1.042 billion yuan in 2017, an increase of 18.27% compared with 881 million yuan in 2016, while the market was only 341 million yuan in 2011. With the development of the industry, the technology has developed and the market’s growth rate has shown an upward trend. From 2011 to 2017 the CAGR of biostimulants in China was 20.46%. The size of biostimulants in China was about 2.643 billion yuan in 2022 and is estimated at 3.290 billion yuan for 2023. As of December 2022, there were over 18,000 registered biostimulants in China (refer to table for details).

There are many companies in China that research and produce biostimulants-related products. For example, there are more than 5,000 humic acid fertilizer production and distribution enterprises and more than 3,300 microbial agents and fertilizer enterprises. As there is no formal independent product certification and registration of biostimulants in China, given its special role and the need of the vast agricultural market, many companies are trying to come up with similar product categories for registration and sales.

China has a vast area of 1.84 billion mu (15mu=1ha) of cultivated land. Since 1980, China’s fertilizer application has increased by 4.5 times, while grain production has increased by 82.8%; the growth rate of fertilizer application has far exceeded the growth rate of grain production. The same is true for pesticide use. During 2016-2021, domestic biostimulant companies made significant progress in new technology and product development, such as the original beneficial fungi and bacteria symbiotic fermentation culture process with the tank and the innovative alcohol extraction of seaweed polyphenols production process, the combination of polypeptides, seaweed polyphenols, antibacterial peptides, organic carbon, natural plant growth regulators and other active ingredients of liquid biostimulants for efficient yield increase, resistance to adversity, increased nutritional effectiveness, improved quality, improved soil and root health, and improved water use efficiency. However, there is so much to be explored and achieved.

What are the current challenges and opportunities for biostimulants in China, especially regarding policy, regulation, market, and research and development?

Challenges and opportunities coexist in China’s biostimulants market. On the one hand, the types and forms of products continue to emerge from a large number of related enterprises, while the domestic players are considerably small and have relatively less competition internally. More than 50% of biostimulant products are international brands and are imported. The market will gradually mature and the gap between domestic and imported products at the technical and quality level will reduce. With localization and cost-effective advantages, the market share of domestic biostimulants enterprises will rise rapidly, and enterprises with technical and cost advantages have more potential for future development.

The main problems faced by China’s biostimulants industry are as follows:

1. Numerous small-scale enterprises with small product differentiation and low profitability compete on natural resources, not on core advanced technologies.

2. Product development largely focuses on the actual effect of biological stimulation and little attention to specific active ingredients (mainly acid-active substances, natural extraction substances, microorganisms and their metabolites, and small molecular inorganic salts).

3. Lack of sufficient field application scientific data.

4. There is less research and development investment towards technology and the targeted product mechanism.

5. Urgent need for industry segmentation standards and industry-standard management.

Chinese biostimulant enterprises established China Biostimulants Development Alliance (CBDA) in 2016; after six years of joint efforts, the domestic biostimulants industry has developed rapidly. In late 2021, CBDA was upgraded to the CBPC of CISIA and held its inaugural meeting, and the first Member Congress was held in July 2022. The establishment of CBPC has laid a better and more solid foundation for the rapid and healthy development of the industry.

What are your short-term and long-term goals and plans for CBPC?

On November 18, 2022, the Ministry of Agriculture and Rural Affairs issued the “Action Plan for Chemical Fertilizer Reduction by 2025” and the “Action Plan for Chemical Pesticide Reduction by 2025” with the goal to reduce the use of pesticides and fertilizers and increase their efficiency to ensure that the utilization rate of pesticides and fertilizers is increased to more than 40%. In alignment with this, the near-term target of CBPC is to actively promote the four different areas of work:

1. The development of new products combining biostimulants with large, medium, and trace elements, fertilizers, and pesticides and the promotion of biotesting and field scientific experiments.

2. Establish the high-flux effect mechanism and rational analysis system of biostimulants and implement comprehensive and accurate analysis of field trial data of innovative biostimulants, pesticides, and fertilizers through high-flux evaluation and screening methods.

3. Gradually establish a general, efficient, and rational test method for active ingredients of biostimulants in the future and promote the establishment of relevant industry standards.

4. Planned integration of domestic and international biostimulants industry resources and establishment of a systematic biostimulants technology research platform, for the development of the industry.

For example, the new European Fertiliser Regulation by the European Biostimulants Industry Committee (EBIC) implemented in July 2022 has triggered the development of new products and technologies. CBPC will organise the study, research, demonstration, and tests to promote the development of biostimulant products and the establishment of standards for Chinese agriculture industry and the exchange and docking with relevant national institutions.

Similarly, in 2018, the CBDA initiated and first established “Biostimulants chitosan” group standard. In May 2023, CBPC initiated the development of the group standard for “Biostimulants peptides” and organised meetings of industry representatives and experts. The bid is expected to be officially launched during the ABS meeting in April.

In the long run CBPC aims to integrate the resources of the domestic and international biostimulants industry and establish the “Biostimulants Engineering Technology Innovation Research Center” and gradually develop into an authoritative technical platform for the development of the international and domestic biostimulants industry.

- Continue to promote the establishment of cooperative technology platforms related to biostimulants: It has planned to set up 10 technology platforms with research teams in different technical directions from major domestic top research universities with existing cooperation basis, and carry out targeted front-end technology research, product development and application technology promotion of biostimulants.

- Establish the enterprise technical service system led by the special committee: Based on the above technical platform, establish the domestic relevant service system, including technical research (support industry common technology basic research), product development, technical consulting, professional training, and technical forum exchanges.

- Exploration of analytical methods and formulation of standards: Based on a large platform, a general method for the analysis of the main active ingredients of stimulating hormone agents is collected and established, laying the foundation for the promotion of industry standards. In the future, we will establish 4 to 5 kinds of analytical methods for the main active ingredients of biostimulants every year. Assist the industry in launching 1-2 groups or industry standards.

What are your thoughts about the BioAgTech World Congress? How is BAW Congress making a difference in the BioAg Industry?

There is a global consensus that biostimulants are a powerful tool to increase food crop production. The global arable land has been reduced by a third in 60 years. Climate and environmental change (Adversity) have resulted in food shortages, environmental pollution, and serious challenges to quality and safety. Biostimulants are innovative and profitable drivers of biocontrol formulations (biocides, insecticides, biopesticides, and plant growth regulators), chemical pesticides (fungicides, insecticides, and herbicides),

nutritional fertilizers, precision farming, and other products. We believe that the BAW conference will also make an essential contribution to this common goal!

BAW Congress is providing the right platform at the right time for the BioAg industry to have the right discussions to harness the potential of biostimulants. There is a need to develop technology to create more efficient products and make these products more easily accessible to farmers over international borders with synchronized regulations. CBPC is confident about seeing more discussions on this and contributing actively.

Leave a Reply