The agricultural industry is undergoing a transformative shift towards biologicals, driven by the dual imperatives of sustainability and efficacy. Multinational corporations (MNCs) traditionally associated with agrochemical products (henceforth, AgroChem MNCs) are increasingly investing in biological solutions to meet evolving market demands and regulatory pressures.

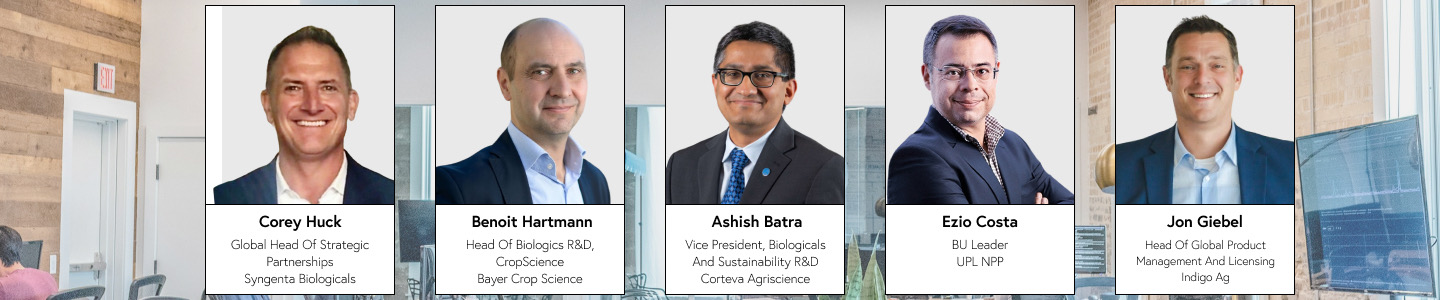

The panel on “Biological Business Heads in the MNC World: Unique Leadership Dynamics in Matrix Organization for Relatively Low Revenue BioAg Inputs Business Units” at the BioAgTech World Congress 2024 brought together leaders from major AgroChem MNCs. The discussion, moderated by Roger Tripathi, CEO and Founder of Global BioAg Linkages, explored the commitment of AgroChem MNCs to the BioAg segment, especially considering the fluctuating agro-economy and the relatively small revenue contribution of biologicals to their overall business. Panelists included Ashish Batra of Corteva Agriscience, USA; Benoit Hartmann of Bayer CropScience, Germany and USA; Corey Huck of Syngenta Biologicals, USA; Ezio Costa of NPP by UPL, Brazil; and Jon Giebel of Indigo Ag, USA. The session was sponsored by NPP by UPL.

This white paper explores the strategic approaches and leadership dynamics of AgroChem MNCs in navigating the complexities of the BioAg segment within the agrochemical industry.

Key Themes and Insights

Current Landscape of Biologicals

Biologicals, encompassing a diverse range of products derived from natural sources such as microbes, plant extracts, and biostimulants, are gaining prominence in global agriculture. While the overall market share of biologicals remains relatively small compared to traditional chemical inputs, their growth trajectory is significant. According to recent analyses, the market is projected to grow from USD 14.7 billion in 2023 to USD 27.9 billion by 2028, with an annual growth rate of 13.7%. North America dominates the market due to strong consumer demand for organic products and strict regulations on chemical pesticides. Other notable regions include Brazil, Europe and Asia Pacific, with countries like Germany, France, China, India and Japan leading the way in sustainable agriculture practices. AgroChem MNCs play an important role in shaping this landscape, balancing innovation with market penetration strategies amidst fluctuating global economic conditions. As such, a consensus emerged on the integration of biologicals with conventional agricultural practices.

Commitment and Strategic Approaches

Corteva Agriscience

Ashish Batra discussed Corteva Agriscience’s approach of leveraging core competencies of blending nature and science along with collaborative partnerships to drive innovation and value creation in BioAg. Since spinning off as an independent entity, Corteva Agriscience has accelerated its focus on biologicals through strategic acquisitions of Stoller in 2022 and Symborg in 2023, positioning itself to capitalize on the vast opportunities within the BioAg segment. Corteva’s products are thoroughly tested through a rigorous pipeline involving chemists, microbiologists, and field scientists to ensure efficacy and safety before reaching the market.

Bayer CropScience

Benoit Hartmann reflected on the journey of Bayer CropScience from their early acquisition of AgraQuest in 2012, to focusing on fewer, more impactful products through an open innovation model, emphasizing quality over quantity in its biological product portfolio. He stressed the importance of developing products that growers can trust. Bayer invests in fewer, high-impact products rather than a broad portfolio of smaller ones. The integration of Serenade exemplifies Bayer’s strategic focus on developing impactful solutions that resonate with growers’ needs while navigating the complexities of biological product development and market acceptance.

Syngenta Biologicals

Corey Huck emphasized that biologicals are seen as additional tools that complement Syngenta’s traditional crop protection and seed businesses. Syngenta’s commitment to biologicals is exemplified through strategic acquisitions and integrations within its existing divisions. The acquisition of Valagro in 2020, a pioneer in biostimulants, demonstrates Syngenta’s proactive stance in expanding its biologicals portfolio. By leveraging synergies across divisions, Syngenta aims to enhance operational efficiency and market competitiveness in the BioAg segment while maintaining a grower-level focus.

NPP by UPL

Ezio Costa explained that NPP (Natural Plant Protection) by UPL’s strategy for biologicals (biocontrols and biostimulants) revolves around integrated crop management programs tailored to regional needs and unique challenges. The focus on sustainability and environmental impact is a key aspect of their strategy. By combining traditional chemical products with biological solutions, NPP by UPL offers comprehensive and sustainable agricultural solutions that manage pest resistance, decrease chemical usage, enhance crop yield and profitability. This holistic approach positions NPP by UPL as a leader in promoting environmental stewardship and agronomic innovation.

Indigo Ag

Jon Giebel highlighted that Indigo Ag has carved a niche in the biologicals market by integrating biological solutions with digital agriculture technologies. They consider increasing the acceptance of biologicals among farmers of paramount importance. As a pioneer in microbial innovation, Indigo Ag facilitates seamless adoption of biologicals in existing farming practices. Their approach involves the use of plant microbiome to enhance plant growth and resilience under various environmental conditions. By focusing on biologicals as a key component of sustainable agriculture, Indigo Ag aims to drive global adoption and reshape agricultural practices. Indigo’s product portfolio includes microbial seed treatments that promote healthy root development and enhance nutrient uptake.

Technological Advancements and Innovation

The panelists also discussed the technological innovations driving the future of biologicals. The rapid advancement of technologies such as microbial strain engineering, fermentation processes, and artificial intelligence is revolutionizing the BioAg landscape. These innovations enhance product efficacy, formulation stability, regulatory compliance and drive down costs, thereby accelerating the farmer adoption of biologicals in global agriculture. AgroChem MNCs are at the forefront of investing in these technologies to drive sustainable agricultural practices and meet evolving market demands.

Challenges and Opportunities

Despite the promising growth prospects, biologicals face several challenges including regulatory complexities, market acceptance, and economic viability. Regulatory frameworks vary across regions, impacting the speed and scale of biologicals adoption. Educating farmers and stakeholders about the benefits of biologicals remains critical to overcoming market barriers and fostering widespread adoption. Economic considerations such as production costs and scalability also influence the commercialization of biological products in global markets.

The Future Outlook and Strategic Recommendations

Looking ahead, biologicals are poised for exponential growth driven by technological advancements, regulatory support, and increasing consumer demand for sustainable agricultural practices. AgroChem MNCs can capitalize on this momentum by prioritizing investments in research and development, strengthening regulatory advocacy efforts, and fostering strategic collaborations with academia, startups, and industry partners. By integrating biologicals into integrated crop management systems and promoting their role in sustainable agriculture, AgroChem MNCs can unlock new growth opportunities and enhance market leadership in the BioAg segment.

Practical Advice for Aspiring Leaders in BioAg

The importance of commitment to innovation, strategic acquisitions, and integration of biologicals with existing practices cannot be overstated. Leaders should focus on developing trust with growers by investing in high-impact products and leveraging technological advancements to enhance product efficacy and adoption.

Conclusion

The panel discussion at the 5th BioAgTech World Congress 2024 provided valuable insights into the unique leadership dynamics and strategies of AgroChem MNCs in the BioAg segment. Despite the relatively low revenue contribution of biologicals, companies are committed to integrating them with conventional practices through strategic investments, technological innovations, and collaborative partnerships to shape the future of biologicals within the agrochemical industry. As global agricultural challenges intensify, the role of biologicals in enhancing crop resilience, reducing environmental impact, and ensuring food security will be indispensable. Embracing a holistic approach to integration and innovation, AgroChem MNCs can drive sustainable agricultural practices globally and lead agricultural transformation in the 21st century.

Leave a Reply